Second home mortgage qualification calculator

Lending requirements on second homes are stricter. According to IRS topic 701 homowners selling their primary residence can often exclude up to 250000 in capital gains on the sale or 500000 if they file jointly with their spouseTo qualify you must have owned the home for at least 2 of the last 5 years leading.

Home Affordability Calculator Credit Karma

If you went through a mortgage workout foreclosure or other process in which a lender forgave or canceled mortgage debt on your home then you must generally report the amount of forgiven or canceled debt as income on your tax return.

. Principal interest taxes and. Once the equity reaches 20 of the loan the lender does not require PMI. Home Equity Line of Credit.

A home equity loan is a lump sum payment as well but it does not include your mortgage payment it is in addition to your mortgage so is sometimes referred to as a second mortgage. This is advantageous if you. Find a loan officer.

If you want to add extra payments to your loan to pay it off quicker please use this calculator to see how quickly you will pay off your loan by making additional payments. Tips to Shave the Mortgage Balance. Second home mortgage rates.

The most common ARM loans are 51. The VA home loan. For example if your home is worth 500000 and your loan balance is 300000 youve got a rather attractive 200000 in home equity.

The IRS guidelines list the following requirements. How long will I live in this home. The first mortgage has a senior position in the capital structure but if you default on either loan you could still lose the house.

Backed by the US. It does nothing for you except put a hole in your pocket. Once you get keys to your home you must keep planning your finances.

Total monthly mortgage payments are typically made up of four components. Except for a few special. The property is a new home either renovated or unoccupied before as a residential property.

Mortgage blog Mortgage 101. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

Second home mortgage rates. Your main home secures your loan your main home is the one you live in most of the time. Home mortgage points are tax-deductible in full in the year you pay them or throughout the duration of your loan.

Your Guide To 2015 US. The longer term will provide a more affordable monthly. Around 050 to 075 higher than your primary home rate.

Our calculator includes amoritization tables bi-weekly savings. Department of Veterans Affairs VA loans are. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

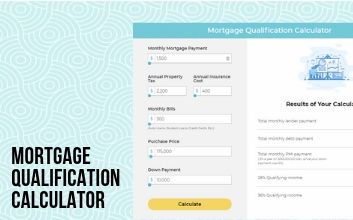

Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default. LTV is based on the total debt to equity ratio for a property so if one borrows 80 of a homes value on one loan 10 of a homes value on a second mortgage then the total LTV. Use our mortgage affordability qualification calculator to estimate how much you can.

The house must be occupied immediately after offsetting the fee and remain so for at least half a year. If you want to reduce interest costs you must budget for extra mortgage payments. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

All FHA loans require the borrower to pay two mortgage insurance premiums. House value must be below AU750000. ASCII characters only characters found on a standard US keyboard.

Note that this not an official estimate. Use this calculator to see if this option would save you money on your home loan. Capital Gains Considerations When Selling a Home.

Homeowner Tax Deductions. Interest rates are also likely to be slightly higher than primary home mortgages. And once you sign the deal you must budget for monthly mortgage payments.

Paying points is an established business practice in the area where the loan was made. Lenders are likely to look for a lower debt-to-income ratio to be sure the buyer can cover the second mortgage payment for instance. Not be satisfied early in lockdowns along with buyers responding to falling interest rates and new needs in a work-from-home.

One factor this calculator does not take into account is capital gains. Must contain at least 4 different symbols. LTV is the reciprocal.

Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. On top of this you must shop for the lowest mortgage rate to save on interest charges. Usually less than 050 higher than your primary home rate Investment property mortgage rates.

A sample qualification requirement for Queensland candidates. Fannie Mae HomePath. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Upfront mortgage insurance premium. So if at all possible save up your 20 down payment to eliminate this.

175 percent of the loan amount paid when the borrower gets the loan. The first number format refers to the initial period of time that a hybrid mortgage is fixed whereas the second number refers to how frequently the rate can subsequently adjust after the fixed period. And thats all it takes to use this mortgage calculator with extra payments.

For many who qualify the VA loan program is the best possible mortgage. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan as well as tell you the maximum amount you can. Mortgage loan basics Basic concepts and legal regulation.

Legal age of 18 years. Report as ordinary income on Form 1040 1040-SR or 1040-NR applicable canceled or forgiven mortgage debt. The actual amount will still depend on your affordability.

Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years. Unbeatable benefits for veterans. Check out the webs best free mortgage calculator to save money on your home loan today.

6 to 30 characters long. Some home owners obtain a low-rate second mortgage from another lender to bypass PMI payment requirements. Second home buyers can also avail of the discounted rates though they will also be required to pay an extra 3 stamp duty.

Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. Second-home mortgages may require 10 down. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

For your convenience current Redmond first mortgage rates and current Redmond second mortgage rates are published below the calculator. To determine your home equity simply take your current property value and subtract the outstanding loan balance.

Rental Property Calculator Most Accurate Forecast

Mortgage Calculator Money

Home Loan Calculators And Tools Hsh Com

Va Mortgage Calculator Calculate Va Loan Payments

Qualifying For A Mortgage

Home Affordability Calculator Sofi

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Home Loan Calculators And Tools Hsh Com

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Home Affordability Calculator For Excel

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How Much A 200 000 Mortgage Will Cost You

Mortgage Calculator How Much Monthly Payments Will Cost

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator